Meant to Combat ID Theft, Unemployment Benefits Letter Prompts ID Theft Worries

Millions of Americans now filing for unemployment will receive benefits via a prepaid card issued by U.S. Bank, a Minnesota-based financial institution that handles unemployment payments for more than a dozen U.S. states. Some of these unemployment applications will trigger an automatic letter from U.S. Bank to the applicant. The letters are intended to prevent identity theft, but many people are mistaking these vague missives for a notification that someone has hijacked their identity.

So far this month, two KrebsOnSecurity readers have forwarded scans of form letters they received via snail mail that mentioned an address change associated with some type of payment card, but which specified neither the entity that issued the card nor any useful information about the card itself.

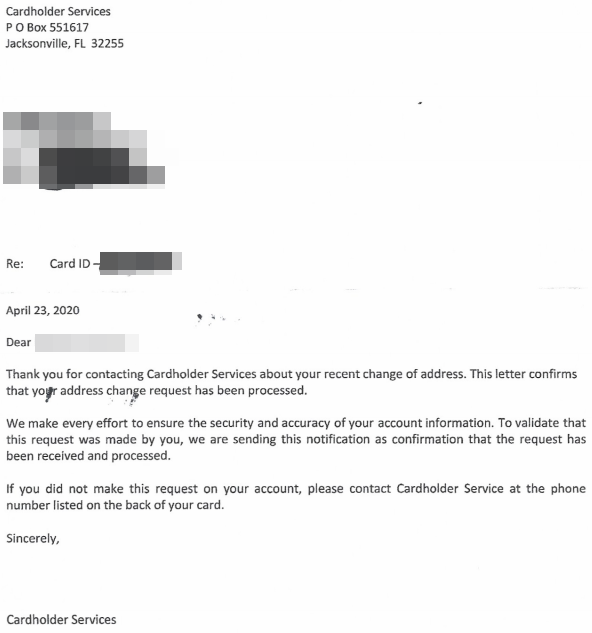

Searching for snippets of text from the letter online revealed pages of complaints from consumers who appear confused about the source and reason for the letter, with most dismissing it as either a scam or considering it a notice of attempted identity theft. Here’s what’s the letter looks like:

A scan of the form letter sent by U.S. Bank to countless people enrolling in state unemployment benefits.

My first thought when a reader shared a copy of the letter was that he recently had been the victim of identity theft. It took a fair amount of digging online to discover that the nebulously named “Cardholder Services” address in Florida referenced at the top of the letter is an address exclusively used by U.S. Bank.

That digging indicated U.S. Bank currently manages the disbursement of funds for unemployment programs in at least 17 states, including Arkansas, Colorado, Delaware, Idaho, Louisiana, Maine, Minnesota, Nebraska, North Dakota, Ohio, Oregon, Pennsylvania, South Dakota, Texas, Utah, Wisconsin, and Wyoming. The funds are distributed through a prepaid debit card called ReliaCard.

To make matters more confusing, the flood of new unemployment applications from people out of work thanks to the COVID-19 pandemic reportedly has overwhelmed U.S. Bank’s system, meaning that many people receiving these letters haven’t yet gotten their ReliaCard and thus lack any frame of reference for having applied for a new payment card.

Reached for comment about the unhelpful letters, U.S. Bank said it automatically mails them to current and former ReliaCard customers when changes in its system are triggered by a customer – including small tweaks to an address — such as changing “Street” to “St.”

“This can include letters to people who formerly had a ReliaCard account, but whose accounts are now inactive,” the company said in a statement shared with KrebsOnSecurity. “If someone files for unemployment and had a ReliaCard in years past for another claim, we can work with the state to activate that card so the cardholder can use it again.”

U.S. Bank said the letters are designed to confirm with the cardholder that the address change is valid and to combat identity theft. But clearly, for many recipients they are having the opposite effect.

“We encourage any cardholders who have questions about the letters to call the number listed on the back of their cards (or 855-282-6161),” the company said.

That’s nice to know, because it’s not obvious from reading the letter which card is being referenced. U.S. Bank said it would take my feedback under advisement, but that the letters were intended to be generic in nature to protect cardholder privacy.

“We are always seeking to improve our programs, so thank you for bringing this to our attention,” the company said. “Our teams are looking at ways to provide more specific information in our communications with cardholders.”

>>More